One of a bank’s central tenets is to loan money to borrowers. Loans allow the lender to pursue worthwhile goals, while the bank reaps monetary rewards for their largesse in the form of interest.

Over time, banks have become trusted institutions that guarantee the proper execution of financial transactions. They are the central establishment through which all our money travels, the center of a spoked wheel that oversees our transactions in relation to other central institutions. The oldest continuously operating bank dates to 1472 in Siena, Italy.

What if you didn’t need a bank to take out a loan?

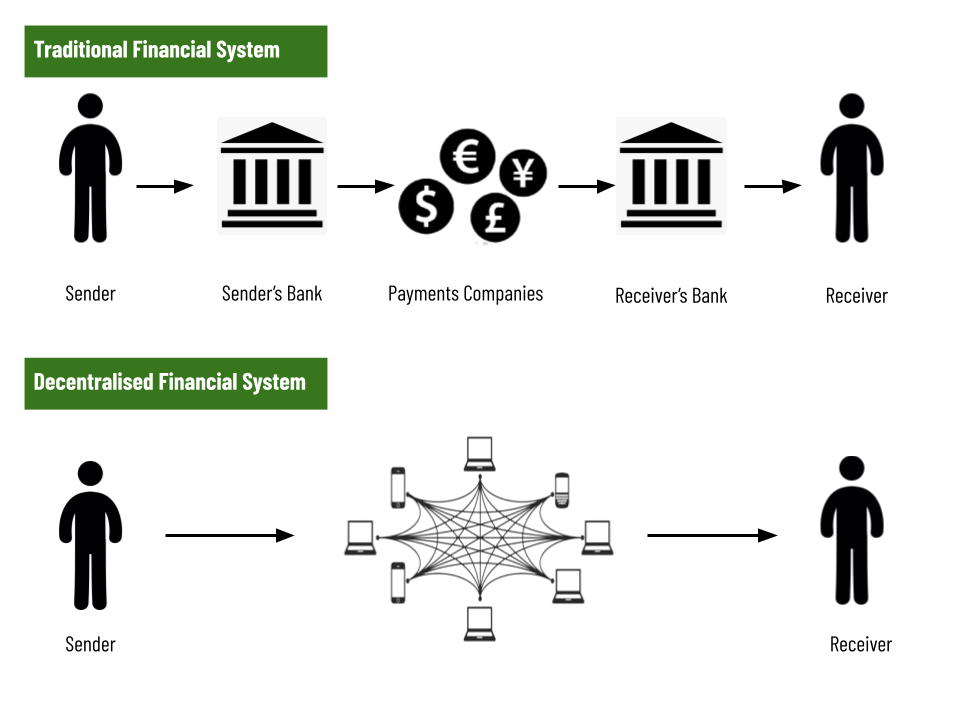

With the rise of blockchain technology, the idea of peer-to-peer transactions that cut out the centrality of banks, has taken hold. A type of distributed ledger technology (DLT), blockchain ensures that data that is stored on a token cannot be tampered with and provides a secure, transparent and encrypted means of recording all of a token’s ownership details.

The decentralized financial system (DeFi) that is being created around the use of cryptocurrencies and digital securities uses blockchain to ensure the terms of loans and open them to a more global and equitable swath of the population. And by reducing the bureaucracy associated with centralized institutions, DeFi lending can become streamlined and less expensive.

Basics Information on Tokens

When our clients ask us what they can do with their tokens once they’ve tokenized their real estate property, we point to the integrated systems that we’ve built into TokenSuite™ that allow asset owners to enter the blockchain economy.

Tokenized real estate is backed by real-world assets that have traditional valuations. They are a digital representation of ownership of an underlying asset. While the tokens themselves are virtual, the property they represent is tangible and is driven by the asset’s NAV (Net Asset Value).

Issuers of any kind of security are responsible for maintaining compliance, which can be a costly and burdensome process. Using TokenSuite™ to properly program digital securities to include all relevant regulations means that they are actually less prone to human error and are far more efficient to handle compliantly.

The Collateralization of Tokens backed by Real World Assets

Now that we’ve established some basics about these tokens, let’s show you how they can be used on a DeFi lending platform that allows asset owners to use these tokens as collateral against a loan.

In other words, through TokenSuite™, SolidBlock puts real world assets compliantly on Web3 rails for the integration of those assets into a DeFi lending platform.

Here’s the big reveal: tokens allow for extreme flexibility when it comes to requesting a loan. In the centralized banking world, a building cannot be fractionalized. If the property owner needs a loan, s/he must put up the whole property as collateral or go through the process of requesting an equity-based loan. If the asset owner defaults on the loan, the bank can seize and sell the property to repay itself. Using tokens, the asset owner can decide to use a small percentage of the tokens that represent a fraction of the building as collateral, thereby keeping possession of the property; a defaulted loan means that the tokens are seized as collateral, not the entire property.

The lending platform is responsible for making sure the asset owner repays the loan. The loan agreement is created as a smart contract which automatically calculates the interest that must be paid to the outside lenders who have used their tokens to create the loan pool.

In short, tokens create financial flexibility for their holders to seek loans using their tokens as collateral rather than their whole property.

What is Collateral?

When we talk about lending agreements, collateral is something of value, i.e., property that is pledged by the borrower to the lender to secure repayment of a loan.

Collateralization, then, is the use of this real world asset as collateral to secure a loan. The implication of this relationship is that if the borrower is unable to repay the loan, the lender may seize the asset to offset their financial loss.

Loans without collateral—uncollateralized loans—are often called unsecured loans. They usually incur higher interest rates since they’re backed only by the borrower’s creditworthiness. Collateralized loans are known as secured loans because the collateral provides a level of reassurance against default for the lender. This means they generally have lower interest rates.

About SolidBlock

SolidBlock is a leader in Tokenization as a Service (TaaS) for real estate, integrating blockchain and Web3 technology to allow real world assets to join in the emerging blockchain economy. TokenSuite™ by SolidBlock empowers asset owners to trade, raise capital, and collateralize their tokenized property on a secure, immutable, and transparent system.

In 2018, SolidBlock successfully tokenized the first commercial real estate project in US history, the St. Regis Hotel in Aspen, CO, pioneering the legal, regulatory and technological framework that has become the industry standard for tokenized assets today.

If you have an asset you’d like to tokenize, fill out this form to set up a discovery call with our team.

by

by