Here at SolidBlock, we see two trends diverging. While traditional real estate prices are slowly falling, tokenized real estate is on the rise. When we eliminate the role of banks and the heavy toll of tying up our savings in a 30-year mortgage, we can discover the benefits of tokenization in a decentralized financial system. And we, we took the road less traveled by. And that will make all the difference (to slightly paraphrase a famous American poet).

The Downwards Trend in the Housing Market

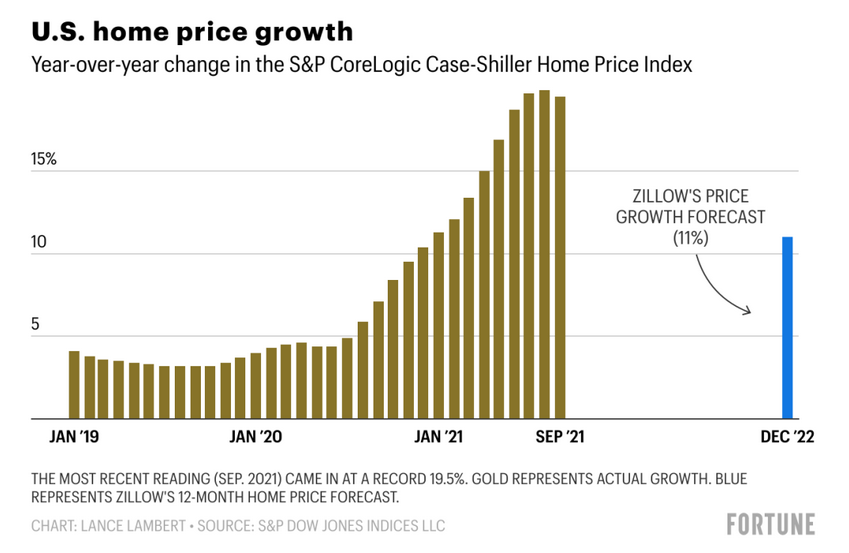

Too good to last, say the experts. The crazy 19.5% jump in housing prices from September 2020 to September 2021, is already slowing down. And that may be beneficial, especially for US homeowners.

What are the predicted real estate trends in 2022, and how will the continuing COVID-19 crisis affect the market?

According to Zillow, a leading real estate marketplace, over the next 12 months, US home prices will rise 11% overall during 2022.

“The housing market may not reach the incredible heights of 2021, but we expect it will be anything but slow next year. Expect the strong seller’s market to persist, the Sun Belt to maintain its top spot as the most in-demand region, and flexible work options to continue to shape housing decisions in new ways in 2022,” writes the Zillow research team in their latest report.

Zillow’s predicted price increase would still be a strong showing. For perspective, Fortune calculates the average rate of home price growth per year as 4.6% since 1980.

Fueling this downturn is mortgage rate uncertainty. High inflation—the highest in nearly four decades—is making it more likely the Federal Reserve Board will increase interest rates this year. If the current average 30-year fixed mortgage rate (3.1%) were to rise significantly, it could push some buyers out of the market.

As home values just posted their second consecutive month of declining price growth, this may be the silver lining.

Other factors affecting the housing market due to COVID-19, says Citi include:

- Increased and enduring adoption of e-commerce and remote working;

- The changing of the frequency and use of offices;

- Continued demand and growth for warehouses, distribution facilities and other properties that facilitate e-commerce; and

- Increased uptake of office space in certain cities where white-collar (i.e., administrative and managerial) jobs are growing fastest.

Digital Assets on the Rise

It seems clear that the COVID-19 pandemic will have an impact on tokenized real estate, too. As housing prices fall, there will be more options for buyers to purchase homes within their budgets and diversify their real estate portfolios.

Additionally, in a year when Moore Global predicted “the tokenized real estate market could hit $1.4 trillion within 5 years,” SolidBlock is optimistic that as digital assets power the logistics of the digital economy, the move from a centralized to a decentralized financial system will continue apace.

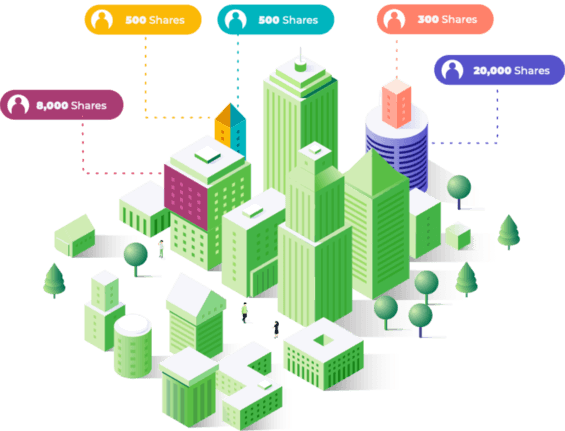

In August 2021, CrowdStreet reported that while tokenized real estate assets—essentially digital shares of properties launched and tracked on blockchain networks—have been around for a few years, “tokenization as a method of raising capital and providing investment liquidity hasn’t yet hit the mainstream of the commercial real estate industry.”

SolidBlock is an end-to-end platform that allows real estate developers and fund managers to raise capital as a benefit of tokenization. The inherent accessibility to these tokenized assets by small investors is the perfect vehicle to democratize investing and an invitation to a wider investor pool. Leveraging blockchain technology for peer-to-peer transactions that bypass traditional banking structure for secure, quick, and paperless trading, may be just the ticket in this new world to raise funds transparently and wisely.

As more and more real estate firms are partnering with established FinTech providers to utilize digital shares—or tokens—there are a greater number of acceptable and compliant alternative trading systems to facilitate their offerings and provide investor liquidity.

SolidBlock added two major projects to its digital marketplace in 2021, with plans to publicize its new online asset tokenization process and add additional large-scale and lucrative properties to its marketplace in 2022.

Red Frog Beach Portfolio is raising $37 million to expand Panama’s first Green Globe Certified sustainable island resort. Backed by Ocean Group International’s 18 years of acquisition, development, and hospitality management, investors can own a piece of paradise and conserve 1000 acres of rainforest, while enjoying long-term returns with the construction of 190 hospitality units and micro-communities. Equity shares are available for purchase under the name frOGI Coin.

Detox Digital Coin is increasing the number of substance abuse treatment programs in the US. This niche commercial real estate sector addresses a rapidly expanding market with an unmet demand—the exploding opioid crisis and the lack of treatment facilities. The first in a series of acquisitions has been identified. It has an extended NNN lease with an annual 3% base rent escalation representing an attractive 7.50% Net Capitalization Rate, and a projected 11% annualized ROI.

We invite you to visit the SolidBlock digital marketplace and become an early investor in this upward swinging trend.

by

by